Bitcoin (BTC)

In our February issue, we noted that "Our crypto timing model indicated that this correction should have concluded by last week. However, for confirmation of a new short-term upward cycle, we're watching for Bitcoin to break above $106,000. Should this occur, it would signal the start of a new bullish phase, potentially peaking sometime between late March and early April."

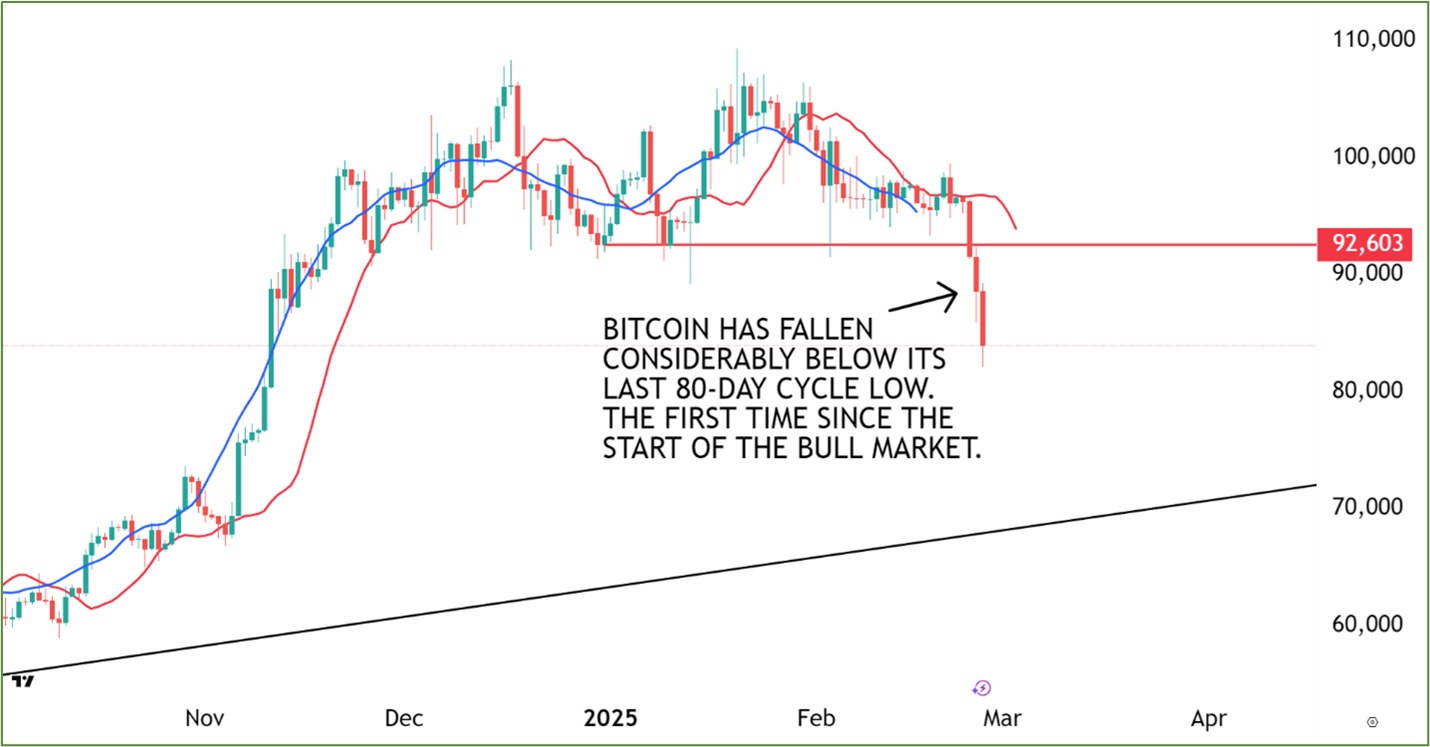

Since then Bitcoin failed to break $106,000 levels and what we are seeing is a temporary pause in the Bull market.

Since BTC dropped below the red horizontal line with confidence, it signals a prolonged period of sideways consolidation meaning short-term low to be delayed until late March or early April. That means, short-term catalysts aside, there’s only one thing that can lift this market back up: A return to the kind of growing liquidity macro environment we saw since before the bull got underway, in October 2022.

For the coming months, we anticipate BTC stabilizing and potentially finding its final short-term bottom as early as next week. Confirmation of this bottom could pave the way for a bull market resumption. However, downside risks persist. A sudden shift in sentiment could amplify selling pressure, particularly if global economic conditions tighten. Investors should remain vigilant, as the next few weeks will be pivotal in determining whether BTC resumes its ascent or faces further stagnation.

Ethereum (ETH) Long-Term Outlook

Shifting focus to Ethereum, the long-term picture is exceptionally compelling. ETH is approaching a local bottom, a fact underscored by technical, psychological, and on-chain indicators. This isn’t about short-term hype—our analysis spans years of price action, revealing ETH as the standout opportunity in the current market.

Historically, the 200-week Exponential Moving Average (EMA) has been a bedrock support for ETH, breached only during extreme capitulation events like the 2020 COVID crash and the 2022 bear market. In both instances, ETH rebounded swiftly after touching this level. In our Last week's alert to our subscribers, we shared that we are increasing our portfolio allocation in Ethereum. The risk-reward here is outstanding! This prolonged consolidation mirrors patterns that historically precede explosive price expansions, akin to XRP’s recent surge.

From a technical perspective, ETH remains within a long-term ascending channel. Its current position near the lower boundary aligns with historical entry zones that have preceded significant rallies. We project a breakout from this channel in the coming months, with $4,000 as the initial target. This level has acted as a formidable resistance, tested repeatedly since 2021. Each rejection has weakened its hold, and the next attempt could see ETH finally breach $4,000, unlocking further upside.

Market Synthesis

For March and April 2025, the crypto market presents a tale of two phases: BTC’s consolidation with a potential inflection point, and ETH’s coiled spring primed for a breakout. BTC’s near-term path depends on a bottoming confirmation and a macro liquidity resurgence, with late March to early April as the critical window for a bullish turn. ETH, meanwhile, offers a rare long-term opportunity, with its current price near historic support signaling undervaluation and imminent upside.

Our Investment Strategy:

BTC: Hold positions, monitor for a bottom as early as next week, and prepare to scale in if bullish signals emerge. Stay cautious of sentiment-driven dips.

ETH: The risk-reward ratio justifies an overweight allocation, with $4,000 as a conservative target.

The interplay between BTC’s stabilization and ETH’s breakout potential will define the market’s tone in the coming months. While risks remain, the data suggests a turning point is near—patience and precision will be key to capitalizing on it.

Stay ahead of the curve 🚀

Fortunexa Research Team

General Disclaimer

- Fortunexa does not receive any financial benefit from recommending any, crypto exchange, website, digital wallet, or any other service provider in this report.

- The information provided here is for general informational purposes only and should not be considered as financial advice. Our primary objective with all our public content is to provide education and assist you in enhancing your own analysis.

- Please do not interpret any of the information presented as legal, tax, investment, financial, or any other form of advice. Nothing within our content should be seen as a solicitation, recommendation, endorsement, or an offer to buy or sell financial instruments (crypto – assets).

- Our aim is not to replace your judgment but to complement it. To achieve success, you must be the captain of your own ship when navigating the world of finance and investments.